Secure, Real Estate Backed,

Investment Options

A Clear Path to Investing with Fund Your Next Flip!

At Fund Your Next Flip (FYNF), we specialize in connecting private investors with curated short-term lending deals that deliver consistent returns with minimized risk. Whether you’re looking to diversify your portfolio, hedge against market volatility, or grow your passive income stream, our private lending model offers an alternative investment class that prioritizes security, transparency, and performance.

Why Private Investing with FYNF Works!

✅ 90-Day ROI Guarantee

We stand behind every deal. Investors receive a guaranteed return on capital for the first 90 days—no matter the market.

📈 Consistent, High-Yield Returns

Earn strong annualized interest rates with predictable monthly earnings. No guessing. No volatility.

🏠 Real Asset-Backed Security

Each loan is backed by real estate collateral, with clear loan-to-value parameters and conservative underwriting.

⏱ Short-Term Liquidity

Typical investments last between 90 to 180 days—giving you the flexibility to reinvest, exit, or roll over quickly.

🔍 Vetted Borrowers & Projects

Our borrowers are seasoned operators—developers, flippers, and builders—with a proven track record of performance.

📊 Transparent Reporting

Investors receive regular updates, project status reports, and access to deal dashboards so you're never in the dark.

💡 Passive Investing, Active Oversight

We handle the origination, servicing, borrower communication, and legal. You just collect returns.

🛠️ How It Works

Your Step-by-Step Path to Passive Income — Secured by Real Estate

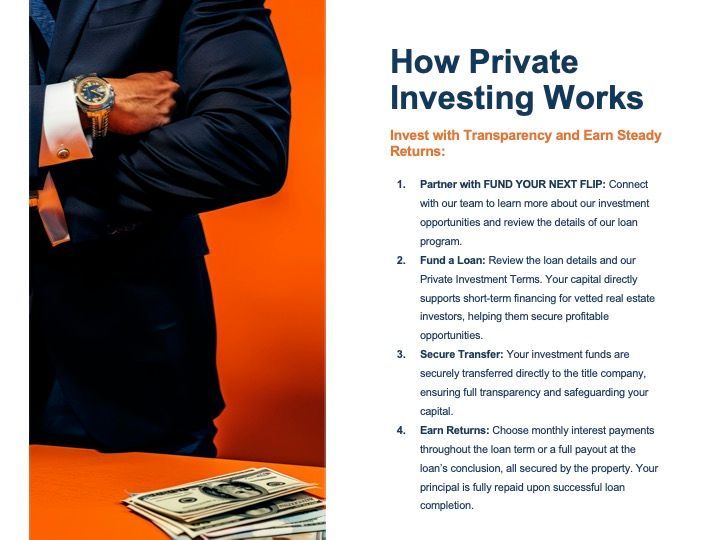

01 Discovery Call

We start with a short call to learn your goals, explain how lending works, and ensure it’s the right fit for you.

02 Current Opportunities

We share vetted, fully underwritten projects ready for private lender participation.

03 Commit & Onboard

You confirm the opportunity, approve the funding terms, and we onboard you by collecting the required information to prepare for closing

04 Closing & Wire

You securely wire funds directly to the title company the day before or morning of closing.

05 Monthly Income & Project Oversight

You receive your wired monthly interest payments, while we manage the loan and project renovation progresses.

06 Full Loan Repayment

Once project is exited, we verify and wire your principal investment and prorated interest, directly to you.

07 Reinvest

After repayment, choose to review current investment opportunities and lend again —no pressure.

Investor Benefits

💰

90-Day ROI Guarantee

Guaranteed return for the first 90 days—no matter what.

📈

Consistent Monthly Income

Monthly payments with high annualized returns.

🏠

Real Estate-Backed Security

All loans are secured by a first-position deed of trust on physical property.

⏳

Short-Term Commitments

Most investments last 6 months, offering fast liquidity.

👷♂️

Vetted Borrowers Only

We fund experienced real estate operators with proven track records.

💼

Fully Passive Experience

FYNF manages the entire process—you simply earn and stay informed.

📝

Straightforward Process

Minimal paperwork, clear communication, and realistic expectations.

🔁

Reinvest with Ease

Choose to roll into the next deal or cash out—no pressure, no lock-ins.

Security Measures

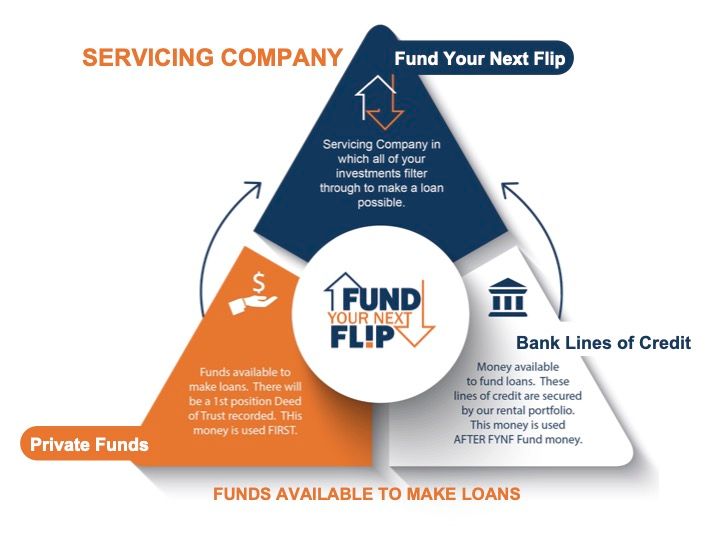

💼 FYNF-Funded First

Each loan is fully committed by FYNF. We simply offer select opportunities to our private investors to earn alongside us.

📊 Conservative Loan-to-Value

We lend no more than 75% of the after-repair value (ARV), protecting your capital buffer.

🧾 Escrow-Controlled Renovation Funds

Renovation draws are managed by licensed third parties with verified progress.

📜 First Lien Position

You hold a recorded deed of trust in first position on the property.

🔎 Verified Borrower Track Records

We screen borrowers for experience, equity, and deal readiness.

📆 90-Day ROI Guarantee

You’re guaranteed a minimum 90-day return, even on early payoffs.

🏦 Funds Wired to Title Company

You never wire funds to FYNF—only to a licensed title company handling closing.

🛑 Lien Release Only After Repayment

Your lien is not released until the full loan is paid off and verified through title.

Review Our Pitch Deck

Ready to Chat

Click the Contact Us button and reach out!